|

1.

Capital Asset Pricing Model (CAPM)

- allows investors to determine a return on a project given a project's risk, market return, and a risk free investment

- Estimate returns on risky assets

- Prices adjust to supply and demand

- Uses indexing

- Indexing - holding a portfolio in the same proportions as a market index

- S&P 500

- Calculate risk premium on securities

-

Optimal Portfolio

is to hold a combination of risky securities as the market portfolio

-

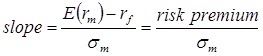

Capital Market Line (CML)

- Point F - risk free asset

- Point M - market portfolio

- In equilibrium, CML represents the best risk-reward combination for all investors

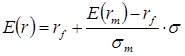

- Notation

- Expected return on project is E(r)

- Return for risk-free security is r f

- Expected return on portfolio m is E(r m)

- Standard deviation for portfolio m is s

m

- Standard deviation is s

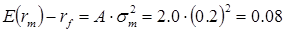

- In CAPM, the equilibrium risk premium is:

-

A is the degree of risk aversion

- Example

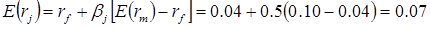

- b is the marginal contribution of a security's return to the standard deviation of a market's return

where

s

jm=cov(security j, market portfolio)

The security market line is graphed as:

- If b

j > 1, security's return is greater than market

- If b

j<1, security has an average risk

- Benefits

- CAPM has performed better than actively managed portfolios

- Cost less to implement than researching for an active portfolio

Example 1: If market return is 10%, a comparable U.S. government security is 4%, and b = 0.5, what return should the investment or project have?

If a project with a b = 0.5 has a return of at least 7%, then proceed with the project. What if everything was the same except b = 2?

You can include the rate of return into a project's net present value of cash flows. If the net present value is positive, then proceed with the project

Corporate Project

- Pays $100,000 on first day of project

- Company receives cash flow

- Year 1 $45,000

- Year 2 $50,000

- Year 3 $55,000

- At end of Year 3, company sells building for $50,000

- Company has a b = 2.0

Valuation of a Stock Price

- g is the growth rate in dividends

- k is the risk-adjusted discount rate

- D j is the stock dividend

- Using CAPM

- r f = 0.04

-

b

steady = 1.5

- Risk premium is 0.08

|

Expect the equity premium to be 1% to 8%. Any out of this range may be unrealistic. |

|

|

Problems with CAPM

- True betas are unknown

- True expected cash flows from a project are unknown

- True expected returns from investments are unknown

- Historical data

- How far back should the data go

- 3 years or 100 years

- World changes; should focus on recent data

- What about the impact of financial bubbles (or stock market crashes)

- Dot-com crash of 2001

- Stock market crash in 1987

- These impact parameters if included

- Predict stock market returns on forecasting dividends

- Higher dividends should result in higher dividends

- Problem - Stock market performed well when dividends were close to zero

- Equity premium

- Historical - stock market earn 3% more than bondholders

- Problem - Use Rule 72

- If the interest rate is 3%, then 72 divided by 3 is 24

- At a 3% interest rate, your money doubles in 24 years

- Problem - why is the purpose of investing in bonds

- Survey of Experts

- Problem - Experts can be wrong

- Example - Recessions - do not ask an economists; economists are the worse at predicting recessions

- CAPM does not distinguish between companies that have low debt or high debts

- If you estimated a CAPM for a corporation

- The corporation issues large amounts of bonds and uses it to buy back stock

- As an investor, the higher debt is worrisome, but CAPM does not reflect it

- Beta tends to be small for large companies and large for small companies

- Some companies may be a good investment

- Beta tends to be high for high-tech industries and low for traditional industries

- Some high-tech investments were good like Microsoft

|

Despite problems with the CAPM, 73% of executives use it to evaluate future projects. |

|

|

Example 2: If market return is 8%, a comparable U.S. government security is 4%, and b = 1.0, what return should the investment or project have?

What if you believe the inflation rate is 2%, then add this to the project's rate or return, yielding 10%.

What if the following events occur in one year when you invest $10,000?

| Outcome |

Outcome (x) |

Probability (p) |

Expected

Return |

| Project payout |

$10,000 (1 + r) |

0.9 |

??? |

| Gov. seizes assets |

$0 |

0.1 |

0% |

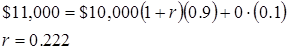

This project needs to earn at least:

Using the payout matrix, the project needs a return of:

- Total rate or return for project = 22.2%

- Risk premium = 4%

- Includes the impact of beta

- Risk free rate of return = 4%

- Inflation premium = 2%

- Risk of government seizure = 12.2%

|