|

Capital Budgeting - analyzing decisions to launch new products, invest in new factories, warehouses, and training

- Project Evaluation estimate cash flows in order to make the investment decision

- New projects are risky

- Involves large sums of money

- Ties up money for a long time period

- Once expansion proceeds, it is difficult to stop

- Calculate the net present value of cash inflows and outflows of the projects

- Net present value (NPV)

- If NPV is positive, then proceed with project

- If NPV is negative, do not proceed with projects

- Investment projects fall into three categories

- Invest in a new product line, such as plants, equipment, and inventory

- Includes research and development

- Invest in automated equipment to reduce labor costs

- Replace an existing plant, or expand capacity

- Definitions

- Net working capital - current assets minus current liabilities

- Ensures a business has funds to finance current operations of a business

- Salvage Value Can sell equipment or buildings for cash when no longer need

- Last term in net present value

- Sunk costs - company paid costs in the past and costs cannot be recovered

- Not relevant for current decision making

- Opportunity costs - the costs of the next best alternative

- If company did not invest in project, then company could invest funds into financial markets

- Reflected by the discount rate

- Adjust discount rate by risk or default premium

- Variable costs - costs vary by production level

- Materials

- Workers' salaries

- Utilities like water, electricity, natural gas

- Fixed costs - costs do not vary by production level

- Bank loan

- Administration

- Corporation president's salary

|

|

1. We estimate cash flows

Operating cash flow (OCF) = Net Income + Noncash Expenses

Operating cash flow (OCF) = Revenue - Total Operating Expenses - Taxes + Noncash Expenses

- Noncash Expenses

- Depreciation expense is an internal adjustment

- No cash flow

- Add to operating cash flow

- Then include changes in investment, if paid in cash

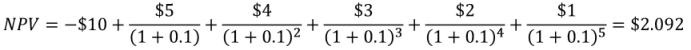

- Example 1: You have to projects A and B

- Cost of capital = 10%

- Both projects have an initial outflow of $10 million

| Year |

Project A

(millions $)

|

Project B

(millions $) |

| 1 |

1 |

5 |

| 2 |

2 |

4 |

| 3 |

3 |

3 |

| 4 |

4 |

2 |

| 5 |

5 |

1 |

Which project has a higher NPV?

Choose Project B, because it has a higher NPV

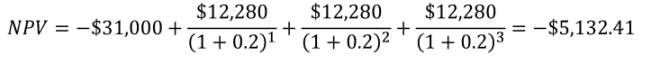

2. Prepare pro forma statements for a project KRS Enterprises

- Sales of 10,000 units/year @ $5 per unit

- Project costs

- Variable cost per unit is $3

- Fixed costs are $5,000 per year.

- The tax rate is 34%

- Project costs is $21,000.

- Project life is 3 years

- The project has no salvage value

- Depreciation is $7,000 per year

- Net working capital is $10,000

- The firm's required return is 20%.

All tables are computed by from the example

Income Statement

Pro Forma |

| Sales (10,000 units / year @ $5 per unit) |

$50,000 |

| Costs |

|

| Fixed Costs |

5,000 |

| Variable Costs |

30,000 |

| Depreciation |

7,000

|

| Earnings Before Interest and Taxes (EBIT) |

$8,000 |

|

|

| Taxes (34%) |

2,720

|

| Net Income |

5,280 |

|

|

| Depreciation |

7,000

|

| Operating Cash Flows |

12,280 |

Note - the income statement is assumed the same for the three years

The change to a firm's balance sheet if firm proceeds with project:

Change in Assets for Project

Pro Forma |

| Item |

Year 0 |

Year 1 |

Year 2 |

Year 3 |

| Net Working Capital |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

| Net Fixed Assets |

$21,000 |

$14,000 |

$7,000 |

$0 |

| Total |

$31,000 |

$24,000 |

$17,000 |

$10,000 |

Total cash flows for life of project

Total Cash Flows for Project

Pro Forma |

| Item |

Year 0 |

Year 1 |

Year 2 |

Year 3 |

| Operating Cash Flow |

0 |

$12,280 |

$12,280 |

$12,280 |

| Net Working Capital |

-$10,000 |

0 |

0 |

0 |

| Net Fixed Assets |

-$21,000 |

0 |

0 |

0 |

| Total |

-$31,000 |

$12,280 |

$12,280 |

$12,280 |

(a) Net present value of cash flows:

Do not proceed with the project!

(b) Average value of assets

(c) Average Return on Assets

Example 3: Company plans to buy a new building

- Pays $100,000 on first day of project

- Pays $110,00 during first year

- Company receives cash flow

- Year 1: $40,000

- Year 2: $50,000

- Year 3: $55,000

- Year 4: $60,000

- Salvage value is $100,000, because company can sell land and building

- Company can invest money and earn a 10% return on investments

Proceed with the project

|